Here are four ways to become an irresistible acquisition target for the search giant…

When we received an offer from Google to buy our company, you can imagine the excitement. Like most startups, an exhausted crew of unshaven entrepreneurs had been throwing themselves at the task 24/7 and the tiny firm was growing by leaps and bounds. It’s obviously huge validation to have your firm acquired by Google or other innovator, but it’s not as rare as you might think. They’ve been buying more than 50 companies per year–we were just one week’s purchase! (Read article on Inc.com)

Why do Facebook, Yahoo and other notables continue to buy companies at a blistering pace, and how can you make yourself irresistible for their next offer?

Solve these four problems first:

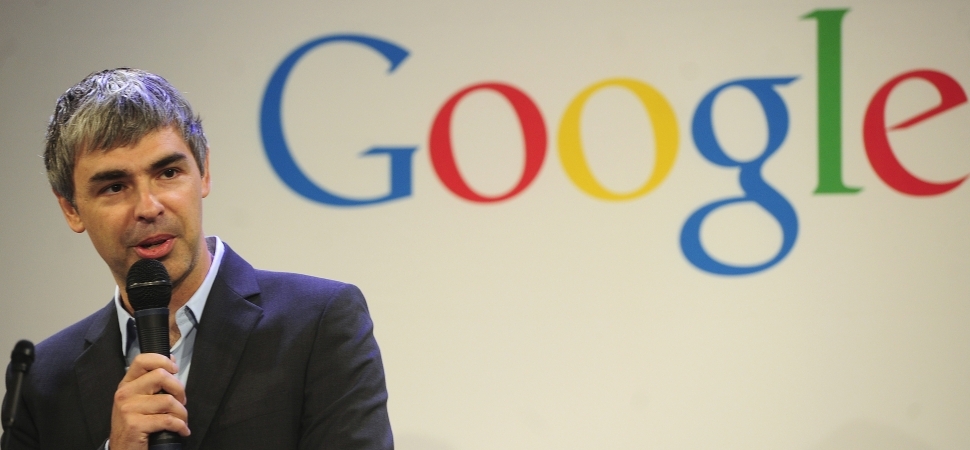

1. Can You Pass The Toothbrush Test? Google CEO Larry Page is legendary for saying he won’t buy your company unless the product or service is something people need and use throughout the day–the toothbrush test. But it’s not only that. The service has to be something people ‘want’ as much as they need, so for more than a dozen years Page has insisted that startup teams demonstrate first-hand experience with solving customers’ most compelling problems. Before Google tapped YouTube to come aboard, founder Chad Hurley would often lament “the great pain of uploading video and the great joy that came from seeing your stuff instantly online,” he mused. “At that time, there was no easy way for the mass of consumers to do this. The solution was born from our own frustration!” Back then only a few visionaries (like Google) could see just how enormous that business would become. I sat next to Larry Page in the audience at the World Economic Forum in Davos after the Google/YouTube deal had closed. On stage there were a bunch of tech prognosticators showing off for the cameras, expressing dismay at Google paying more than a billion for YouTube (back when that was rare). Page turned to me with a smirk: “I think we’re going to do okay on YouTube,” the Google cofounder chuckled. “Don’t worry about us,” he started to whisper. “No one seems to realize yet just how necessary it will be for people to broadcast themselves every day!” (Broadcast Yourself was one the original YouTube slogan.) I told Larry Page that even the stock market was smarter than the critics in the snowy Swiss Alps that day, as Google’s stock price had leapt almost $2 billion after the deal was announced.

2. It’s The Ugly Stepchild Not The Sexy Stuff That Wins Long-Term. While some successful businesses capture the public’s imagination and dominate the media’s attention at the beginning, those companies often become the rare, few victors in fiercely competitive markets. More often it’s better to solve a problem that may be less glamorous, but still necessary to a market niche. At the turn of the century, “bandwidth was limited, so it would take forever to upload even YouTube videos, and playback was haltingly slow,” Hurley observed. YouTube was an ugly stepchild in the sexy media industry, but it would soon become a necessity.

3. The Dirty Little Secret About Innovation. Innovation requires experimentation, but what’s the most likely result from most bold new tests? Failure! Do big company managers enjoy high-profile flops with their bonus and reputation on the line? Nobody does, with one notable exception: startups that lack the scale, experience, customers and resources–they don’t have the obvious competitive advantages of their bigger competitors–so they have no other choice but to take disruptive action and embrace daring risks to solve problems, please customers and win market share. For all the lip service given to innovation and entrepreneurship, almost no well-established leaders do it in a serious way because they have to deliver quarterly earnings and are burdened by regulatory complexities and peer pressure at their own companies. There isn’t much incentive to innovate if you’ll be fired for doing it!

4. If You Can’t Beat Them, Buy Them. For many risk-adverse firms, the solution is to hunt for startups whose businesses are have done the pesky R&D for them. Why not buy a company that has already slogged through the humiliating setbacks and taken the research and development risks and demonstrated successful traction? Google is a master at this kind of talent search. As Darwinian economic forces cull the vast majority of the herd of entrepreneurs in any emerging industry, the visionary buyers have the opportunity swoop in to acquire and integrate the most promising, road-tested survivors.

As an executive coach and angel investor, I often lay half-awake at night with dreams about getting that exciting call from an acquirer. I’m grateful to have been a part of more of dozen happy exits–along with dozens of happy entrances by visionary managers at big companies. Each time I’m amazed to see how great leaders embrace risk so that the company and their customers win over and over again.

Let’s hope you’re next!